How Tariffs Impact Businesses—and What That Means for Insurance Brokers

- Wes Sheffield

- May 5, 2025

- 3 min read

Understanding Tariffs: A Rising Concern for U.S. Businesses

Tariffs—government-imposed duties on imported goods—are often used as a tool in trade negotiations, but they can have real and immediate effects on business operations across industries. For insurance brokers, understanding these impacts is critical, as tariffs can alter not only a company’s cost structure and operations but also their risk profile—ultimately influencing insurance quotes and underwriting decisions.

The Business Impact of Tariffs

When tariffs are introduced or raised, they can lead to several key changes in a business:

Increased Operational Costs

Businesses that rely on imported materials or products will face higher costs, forcing some to raise prices, reduce margins, or cut back in other areas such as staffing, logistics, or capital improvements.

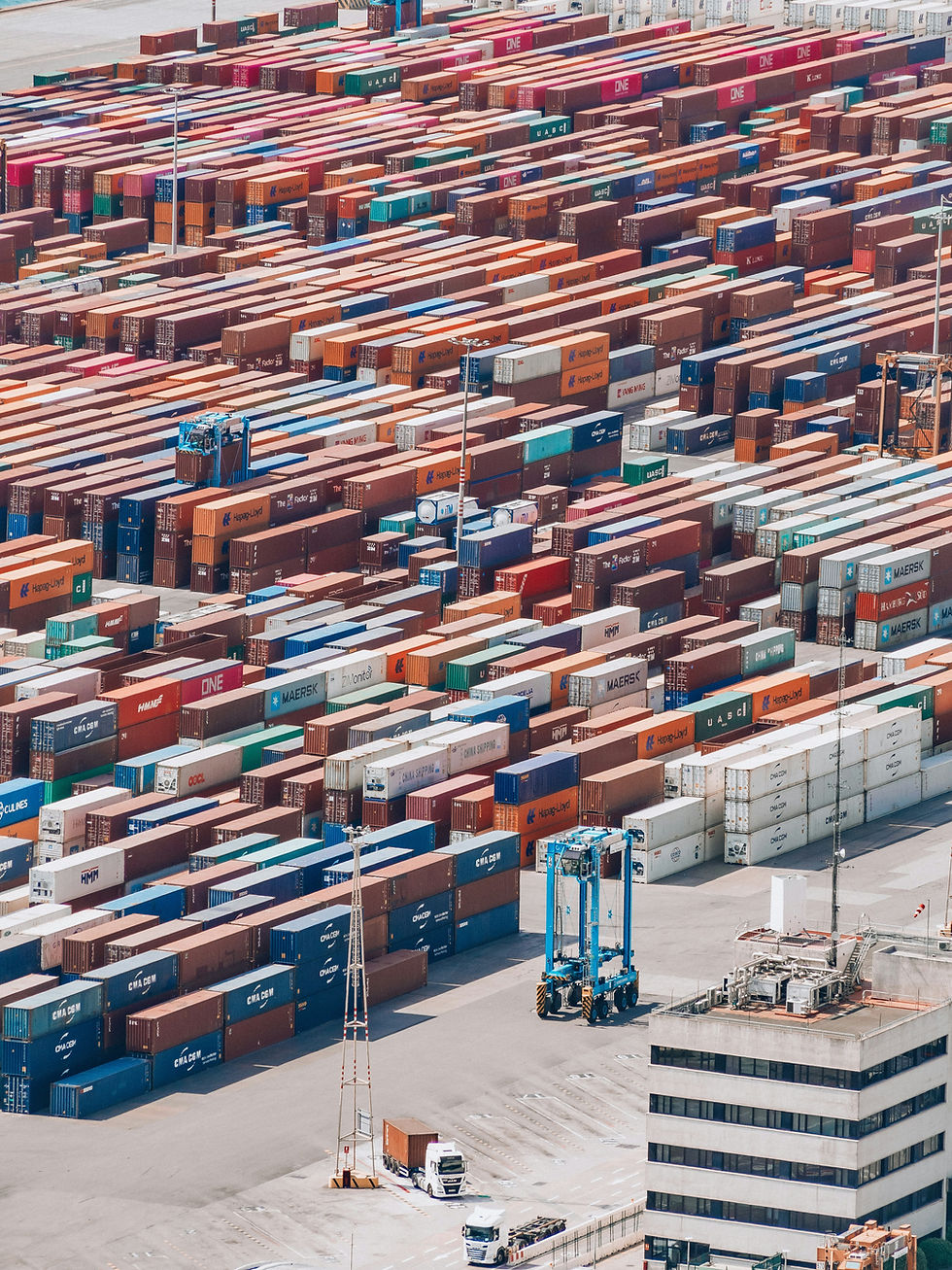

Disrupted Supply Chains

Tariffs may compel businesses to seek new suppliers or routes, often under time pressure. These rapid shifts introduce new logistical and operational risks that insurers will factor into quotes.

Asset Valuation Shifts

The cost of imported equipment, inventory, and construction materials may rise sharply. As replacement costs change, so too will the valuation of insured assets—impacting property coverage limits and premium pricing.

Business Interruption Exposure

Volatile trade environments increase the likelihood of supply chain interruptions or delays, which could trigger business income losses. Brokers may see increased demand for Business Interruption or Contingent Business Interruption coverage.

What Insurance Brokers Should Watch For

As tariffs evolve, brokers must be ready to respond with clarity and expertise. Here’s how tariff changes may affect your quoting process:

1. Updated Risk Assessments

Underwriters may request updated business models, financials, or supply chain maps as part of the underwriting process—especially for manufacturing, construction, and retail accounts.

2. Rising Replacement Cost Estimates

Higher material costs affect property insurance quotes. Brokers should be aware that valuation worksheets may need adjustments and work with clients to avoid being underinsured.

3. Liability Considerations

Changes in product sourcing and suppliers may introduce new liability exposures. For example, using alternative overseas manufacturers may increase product liability risks, especially if quality controls differ.

4. Fluctuations in Cargo and Inland Marine

Tariffs can redirect how and where goods are moved, increasing exposure under marine cargo, inland marine, or stock throughput policies. This can lead to rate changes or revised limits based on updated transit routes or volume.

5. Policy Revisions and Endorsements

Brokers may need to add endorsements or expand coverage types—such as supply chain coverage, trade disruption insurance, or contingent time element coverage—based on the client's new operating realities.

How Amelia Underwriters Helps Brokers Navigate Tariff-Driven Challenges

At Amelia Underwriters, we understand that today's brokers need more than a quoting platform—they need a partner who is tuned into economic shifts and can respond quickly to changing risk environments.

Our Virtual Underwriter platform is designed for speed and precision, helping you quote and bind a wide range of commercial risks—even as external factors like tariffs impact your clients’ operations. We offer flexible underwriting for industries most affected by global trade, including:

Importers & Exporters

Distributors

Manufacturers

Contractors & Builders

Retail & Wholesale Operations

Final Thoughts

Tariffs are more than a political headline—they’re a dynamic economic force that can reshape how your clients do business. As an insurance broker, staying informed allows you to proactively adjust risk recommendations, communicate coverage changes, and help clients maintain stability through market shifts.

Amelia Underwriters is here to help you adapt and stay competitive. If you're ready to quote smarter, faster, and with a team that understands the bigger picture, let’s connect.

Ready to Partner with a Wholesale Broker Who Moves at Your Speed?

Get appointed with Amelia Underwriters or log into the Virtual Underwriter platform to start quoting today.

📞 (904) 660-0070🌐 www.ameliaunderwriters.com✉️ info@ameliaunderwriters.com